A chargeback is bad for any business, but its effects can be particularly devastating on an affiliate-based one.

In the affiliate marketing sense, when it comes to targeted promotion, honesty and transparency continue to dominate and be the best policy. When you're straightforward about activities, your traffic has a picture perfect view on why they should register or sign up for something — and chargebacks then become less likely to occur.

But if you mislead, deceive or do just about anything in pursuit of that sale, it can lead to disastrous consequences.

On October 1, 2019, Visa will be updating their regulations used to monitor and mitigate risk.

These changes could have an impact on your business.

What is a Chargeback?

You'll recall we talked a little bit about Chargebacks here in the past.

Chargebacks are the reversal of funds — essentially refunds — demanded by the consumer when he or she contacts one’s banking establishment over a disputed charge or transaction.

Everybody’s affected by chargebacks differently (there’s an expected cause/effect on the merchant's end, the consumer’s end… and hell, there’s especially one to be felt on the affiliate end!).

If the consumer’s banking establishment agrees there’s merit to the dispute, the chargeback process gets initiated and the financial institution forcibly returns the funds to consumer—at the expense of the merchant—coupled with some kind of financial penalty against the merchant (chargeback fees).

From a merchant’s perspective, not knowing how much cash can be withdrawn from one’s business account is neither fun nor practical... and that’s not even the scariest part!

If the financial institution or credit card company FEELS or BELIEVES there’s “too many” chargebacks against a merchant—the bank CAN and often times WILL— BAN and/or FREEZE the merchant’s business account… essentially paralyzing that merchant’s business… leaving them totally handicapped and unable to continue honoring their bills.

How do chargebacks affect the average person?

To the average Joe, these actions against a merchant probably sound quite reasonable and just right about now—we mean, why wouldn’t they?

In many people’s minds: if a merchant has that many strikes against them, there’s probably an underlying issue with their business and they should be dealt with.

Sounds reasonable, right? But no, that’s where conventional wisdom ends and the threat of fraud and chargeback abuse begins.

If merchants and the affiliate industry weren’t already plagued by scammers or simply people trying to game the system—knowing there’s a way to get money back after enjoying a premium, non-free service—Visa’s new chargeback policies (which we’re going to talk more about in a second) wouldn’t even be a problem.

You see, e-commerce companies across the board are fearing the chargeback more and more. A few chargebacks over the limit… and you read how one’s business can have disastrous consequences!

History Class: Visa Has Gotten Stricter Over the Years

2015: Visa Europe is acquired by Visa Inc. (US)

The purchase of Visa Europe by Visa Inc. in 2015 was followed by a series of measures aimed at standardizing the company’s practices on both continents—and Visa’s Chargeback policy was no exception.

2016: Introduction of Visa’s chargeback monitoring program

Visa’s Chargeback Monitoring Program (VCMP) had actually been announced and slated for the beginning of 2016 — but it didn't actually take effect until July 1, 2016.

Visa’s Monitoring Program meant the era of greater scrutiny

For merchants, among the changes were the European domestic chargeback rates being standardized to the American ones.

In other words, the authorized chargeback rate of 2% of sales (or 200 chargebacks per month) was slashed in half. Ever since July 1, 2016, the new chargeback rate has been set to 1% of sales (or 100 chargebacks per month).

If a merchant reaches this cap, the merchant enters Visa’s Chargeback Monitoring Program, which can eventually lead to disqualification from all participation in the Visa Enterprise.

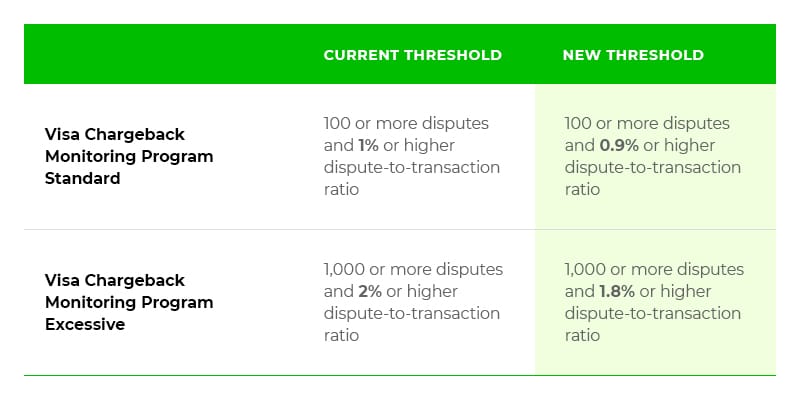

2019: Visa Chargeback policy ratio decreases from 1% to 0.9% on October 1, 2019

In other words, the chargeback policy will become 10% stricter.

If you think that Visa’s new policies won’t affect you... think again!

The new policies and stricter regulations imposed by Visa will have a ripple-like effect on marketing campaigns and affiliates all around the world—and in ways many might not initially realize.

Risk Management

Entering the Visa Chargeback Monitoring Program can have harsh consequences.

Therefore, every online business should be taking this risk seriously.

On April 12, 2019, Mastercard officially began updating regulations for merchants and the way they're able to bill customers.

But a risk management approach begins by ensuring the quality of your traffic.

That's step one, always and forever. You can do your part by understanding the offers you promote and the entire process of the funnel.

There's a reason why we've warned against deceitful tactics in our TOS since our earliest beginnings!

The Effects on the Affiliate Industry

These new rates will undoubtedly have an effect on adult web marketers at the end of the day.

More Careful Providers

You can bet that companies will be keeping a closer eye on all business and activity and will be doing everything in their might to prevent dissatisfied consumers and—ultimately—doing everything in their power to avoid making their way into the VCMP.

What does it mean for affiliates and would-be affiliates?

It means providers and networks will both be looking for greater sources of qualified traffic — traffic that is far less likely to be prone or linked to chargeback abuse.

Less Aggressive Campaigns & Billing Processes

One way to achieve a higher percentage of qualified traffic is to focus less on aggressive campaigns, and far less on aggressive billing systems.

For example, the process of providing a free membership trial in exchange for the submission of a valid credit card number has always been commonplace in various industries.

It has always been the user’s sole responsibility to read all relevant print and details before any form submission to avoid additional billings that may be attached to a respective offer, or should a user not cancel his or her trial membership after an allotted time period.

Though again once a longstanding practice—some providers may begin to re-evaluate this.

Along the same lines: while the more aggressive campaigns are historically known to generate more conversions than other types of campaigns… these campaigns in turn result in a greater number of chargebacks as well.

Therefore, it’s the provider who will review acceptable practices and the provider who will pay closer attention to the affiliates and partners they choose to work with.

More Monitored CPA Networks & Affiliates

Since the adult industry is more prone to chargebacks than other kinds of businesses, providers will now be more demanding than ever when it comes to needing established affiliates with proven track records and quality traffic.

Of course, this means that they’ll also be asking CPA networks (such as CrakRevenue) to closely monitor their affiliates’ campaigns.

Therefore, affiliate marketers on all fronts will have to be REALLY careful not to mislead in any way if they wish to continue promoting some of the most rewarding offers on the market.

We repeat: It's of the utmost importance to hone your promotional strategy so traffic isn’t misled.

So What Should An Affiliate Do?

Do what any skilled businessman would do: adapt.

And this also means talking with one’s Account Manager if there’s any question in one’s mind when it comes to acceptable promotional methods or practices.

Remember, you’re not alone in this process, either.

Our team of skilled Affiliate Managers will always be there to help you improve the quality of your traffic and adjust your campaigns every step of the way if you’re struggling to meet the new market requirements.

Reach out to us any time at support@crakrevenue.com - we’re always eager to hear from you.

At the end of the day, improving traffic quality really means: more money for you, less stress for the provider, and healthy business relationships all around!

Indeed, this policy is actually a GOOD thing for web marketing in general. This pushes us to work even more on the quality of our campaigns and our traffic… which - in the end - is actually the key to a sustainable business model.